Configure and import currency exchange rates

Before you can import exchange rates, you must set up the information that is required by the providers who offer the exchange rates.

Knowing how to configure exchange rate providers helps reduce the time to manage ongoing changes in market regarding exchange rates. Even though companies can either develop, purchase, or subscribe to the exchange rate provider services, you can find built-in providers in Finance.

Exchange rate types

Exchange rate types are shared data across Finance and only need to be set up once. Exchange rate types are a grouping that allows different exchange rates for two currencies. Examples include Buy, Sell, Spot, and Budget. If a company trades with multiple currencies, they must use multiple exchange rate conversions.

A currency pair can only exist once and entering a reciprocal pair isn't supported. Therefore, if you already have USD to EUR set up, you can't create a EUR to USD currency pair for the same exchange rate type.

Finance calculates the reciprocal rate automatically if it can't find the exact currency pair during the translation conversion. If you only have USD to EUR set up and you're entering a transaction amount in EUR in a legal entity where USD is the accounting currency, Finance first searches for the exact currency pair in the rate type used by the ledger: EUR to USD. If not found, it then searches for USD to EUR and calculates the reciprocal rate.

Because the same currency can have several rates, the posting date determines the rate applied.

Example

An exchange rate is entered on January 1, and another exchange rate is entered on February 1. If a sales order is invoiced on January 15, the exchange rate from January 1 is used to calculate the invoice amount. If a sales order is invoiced on February 2, the rate from February 1 is used as an adjustment.

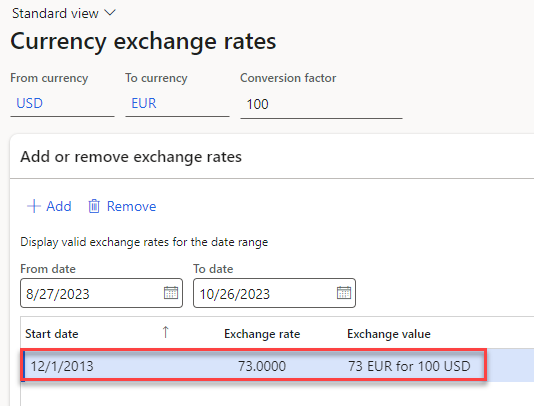

Use the Currency exchange rates page in General ledger > Currencies > Currency exchange rates to see the exchange rates that are set up for this example.

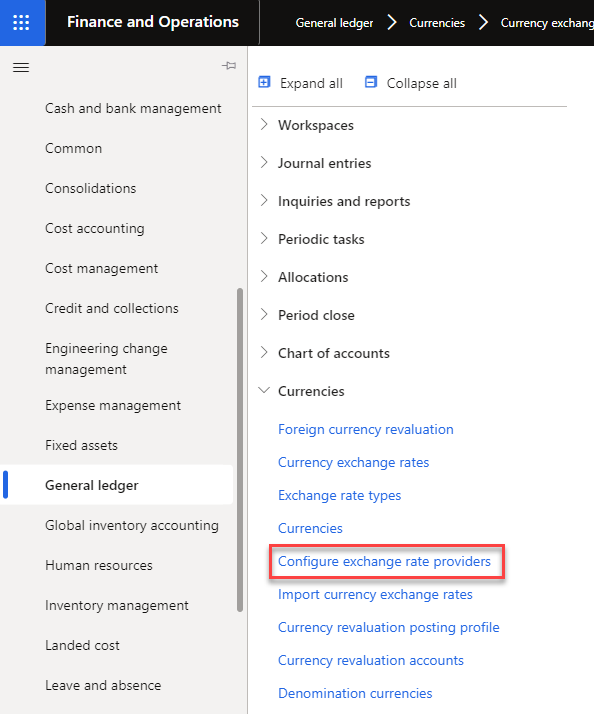

Use the Configure exchange rate providers page in General ledger > Currencies to select the exchange rate providers.

Some exchange rate providers are included with the demo data in Finance.

Import currency exchange rates

If a legal entity receives invoices in foreign currencies, they must convert the foreign currency into the local currency. This means that up-to-date exchange rates for different currencies are required.

This unit provides an overview of the required settings and processing for importing foreign exchange reference rates published over the internet by the exchange rate providers, such as the Central Bank of Europe.

You can import exchange rates from the exchange rate providers and set them up on the Currency exchange rates page. Use the Import currency exchange rates page to import the exchange rates.

Watch this video to learn how to import currency exchange rates.

Manually enter exchange rates

If you choose to manually enter your exchange rates instead of importing them, you must enter the rates for each combination of currencies that your system uses. Each combination is called a currency pair.

Note

Each combination is bi-directional. For example, if you enter a rate for USD to MXN, the MXN to USD rate is implied. If you try to enter both USD to MXN and MXN to USD, the Exchange rates are already defined between currency USD and currency MXN. You can't enter reciprocal exchange rates for the same exchange rate type message displays.

When you enter currency exchange rates, the entries apply to all legal entities in your environment. You don't enter exchange rates for each legal entity separately. Triangulation is a separate process that was described earlier in this training. If you're using triangulation, you update the exchange rate between each currency and the triangulated currency, not the individual currencies that use the triangulated currency. For example, you would update the currency for USD to EUR, but you wouldn't (and can't) update the exchange rate for EUR to SKK (Slovakia Koruna) if you're using EUR as the triangulation currency for SKK. The exchange rate between SKK and EUR is fixed.

To manually enter exchange rates, follow these steps.

Go to General Ledger > Currencies > Currency exchange rates. Some currencies are loaded when your system is installed but you can add more currencies as needed. Select the Currencies menu item to add a new currency so that you can enter exchange rates.

Select the Currency exchange rates menu item, and then select the Exchange rate type. Each type has different rules for managing the exchange rate. A type may require a daily entry or use an average for the month.

When you have selected the exchange rate type and you know what rate to enter, enter a new currency pair or select a currency pair to change.

Because rates change often, add a new date entry and new rate instead of changing an existing entry. The system only requests a Start date. It uses the latest date before the date of each transaction to choose the correct currency exchange rate. When you enter and save a new exchange rate, the rate is immediately used for any transactions that fall within the date range that you entered.

The screenshot shows where you enter a currency exchange rate. The Conversion factor field represents the number of units in the From currency that you're converting to the To currency. Most organizations set the value of this field to 1 or 100.

Select from more exchange rate types for currency revaluation

Finance supports revaluating open vendor invoices amount and open customer invoices amount into a company's accounting currency and reporting currency using the exchange rate type defined on ledger setup. However, users can't use exchange rate types other than the ones defined on ledger setup.

This feature provides multiple options of exchange rate types for accounts payable and accounts receivable foreign currency revaluation.

The following options are available in this feature:

- Use a default exchange rate type on ledger setup.

- Use an additional exchange rate type on accounts payable parameters and accounts receivables parameters.

- Use an additional exchange rate type on customer group and vendor group.

Go to Accounts payable > Setup > Accounts payable parameters and select the Ledger and sales tax tab. Expand the Foreign currency revaluation FastTab to specify exchange rate types.

Define foreign currency revaluation posting profile

To define currency revaluation adjustment accounts to a granular level, for each currency and for each module, use the currency revaluation posting profiles. By using this feature, you can post currency revaluation adjustments to different currency adjustment accounts. You can define the accounts across the module for specific groups or specific accounts. For example, you can use this feature to adjust ledger accounts, vendor groups, customer groups, and more. To define foreign currency revaluation posting profiles, go to General ledger > Periodic tasks > Foreign currency revaluation.