Manual and automatic methods to create fixed assets

You can create fixed assets manually, and you can have the system automatically create them.

Create fixed assets manually

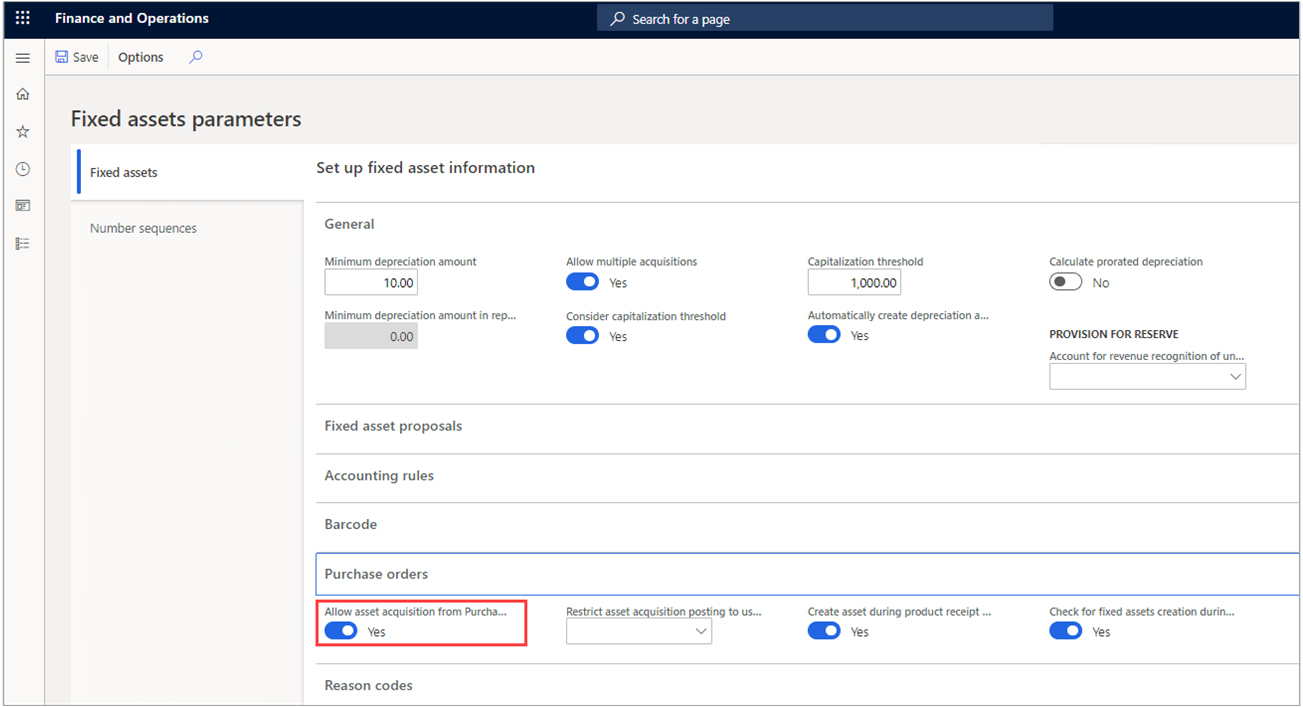

When you post a vendor invoice that has a fixed asset number entered in the lines, if the Allow asset acquisition from purchasing option is selected in the Fixed assets parameters page, the system posts the acquisition automatically and the status of the asset changes to Open.

If an acquisition can't be posted, you can enter an acquisition transaction manually in Fixed assets. Alternatively, you can use an acquisition proposal in the Fixed assets journal to create multiple acquisition transactions at the same time.

If you set up Fixed assets to limit acquisition transaction posting to a specific user group, you must be a member of that user group to post acquisition transactions from invoices.

Go to the Fixed assets parameters page in Fixed assets > Setup > Fixed assets parameters.

Create fixed assets automatically

When you post a product receipt that has the Create a new fixed asset option selected for a line, the system creates a new fixed asset that has a status of Not yet acquired. Then, when you post a vendor invoice with a new fixed asset, the system posts an acquisition transaction for the new asset and the asset status changes to Open. This scenario only occurs if you set up Fixed assets to allow for asset acquisitions from Accounts payable and if you're a member of a user group that can post acquisition transactions.

If the New fixed asset option isn't selected on the purchase line when you posted the product receipt, but it was selected when you posted the vendor invoice, the system creates and acquires the new fixed asset with a status of Open. This scenario only occurs if you set up Fixed assets to allow for creating and acquiring. The system doesn't create an extra asset when you post a vendor invoice if one was already created when you posted the product receipt.

Capitalization threshold

When you use a method where the system automatically creates and acquires the asset, you can set up the system to verify whether the purchase amount of the fixed asset meets a specified capitalization threshold for asset depreciation. If so, you select the Depreciation option in the books for the asset when you create it from Accounts payable.

A capitalization threshold is a currency amount that determines whether assets are depreciated if they meet the specified amount.

For example, if you purchase an asset and the purchase amount is less than the capitalization threshold, the asset isn't designated to depreciate. If the purchase amount meets or exceeds the threshold, the asset is designated to depreciate.

You can set up the capitalization threshold in the Fixed asset groups page.