Cash flow tax registers

Overview

Cash flow tax registers are generated based on accounting data from general ledger transactions. There are two types of tax registers:

- Cash payment receipt (Cash flow = Pay in): The cash inflow tax register is designed to consolidate cash inflow information to identify either income that is related to current and future periods, or transactions that determine future expenses.

- Cash payment issue (Cash flow = Expense): The cash outflow tax register is designed to consolidate cash outflow information to identify either expenses that are related to current and future periods, or transactions that determine future income.

Cash accounts include the following types of accounts:

- Cash: This type includes the company's cash accounts (ledger account 50).

- Bank: This type includes accounts that reflect the balance on bank accounts (ledger accounts 51, 52, and 55.1 for accounting for letters of credit).

- Other: This type includes other special cash accounts.

Accounting transactions where ledger account 57 (Transfers in transit) is specified as a credit account should be excluded from the tax registers. The following types of accounting transactions should also be excluded:

- Debit ledger account 51 = credit ledger account 50 (Deposited to the bank in cash)

- Debit ledger account 50 = credit ledger account 51 (Received from the bank in cash)

Set up the tax registers

Set up account interval groups for Bank, Cash, and Other account types

- Go to Tax > Setup > Profit tax > Account interval groups.

- On the Action Pane, select New.

- In the Interval group field, enter a name for the new account interval group. For this example, enter Bank.

- On the Account intervals FastTab, select Add.

- In the Account (Interval: From) field, select a ledger account. For this example, select 51.000.

- In the Account (Interval: To) field, select a ledger account. For this example, select 51.999.

- Repeat steps 2 through 6 to create a second account interval group that is named Cash, for ledger accounts 50.000 through 50.999, and a third account interval group that is named Transfers in transit, for ledger accounts 57.000 through 57.999.

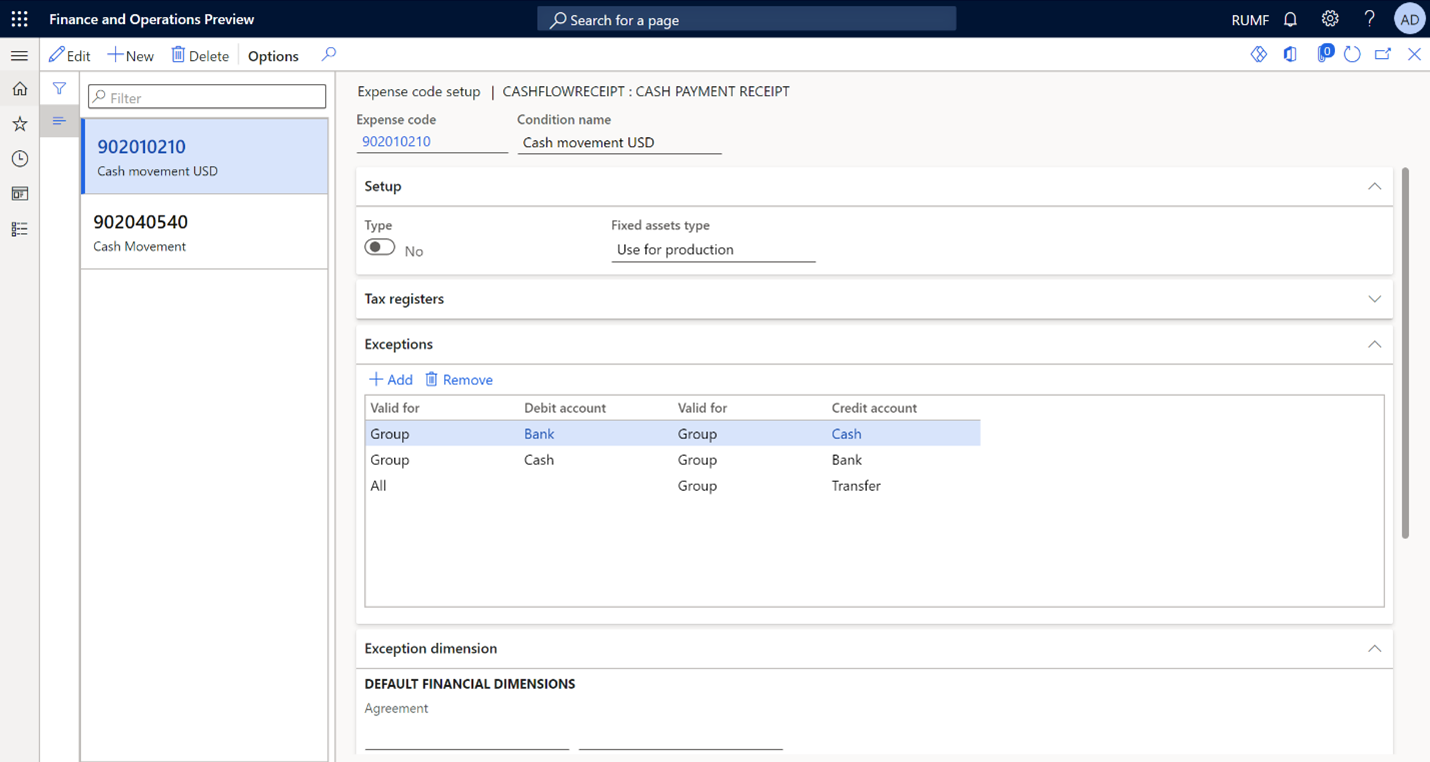

Assign expense codes to tax registers and set up exceptions

Follow these steps to set up expenses for the Cash payment issue and Cash payment receipt tax registers.

Go to Tax > Setup > Profit tax > Registers.

Select the tax register, and then, on the Action Pane, select Expense codes.

On the Action Pane, select New.

In the Expense code field, select the expense code. The tax register will reflect transactions that have the selected expense code.

In the Condition name field, enter a description.

On the Exceptions FastTab, create the following exceptions to specify that the tax register won't reflect the cash flow between cash accounts and bank accounts, or the cash flow for transfer accounts:

To exclude transactions from cash accounts to bank accounts, select Add, and then set the following fields:

- Debit fields: Set the first Valid for field to Group and the Debit account field to Bank.

- Credit fields: Set the second Valid for field to Group and the Credit account field to Cash.

To exclude transactions from bank accounts to cash accounts, select Add, and then set the following fields:

- Debit fields: Set the first Valid for field to Group and the Debit account field to Cash.

- Credit fields: Set the second Valid for field to Group and the Credit account field to Bank.

To exclude transactions for transfers in transit, select Add, and then set the following fields:

- Debit fields: Set the first Valid for field to All.

- Credit fields: Set the second Valid for field to Group and the Credit account field to Transfer.

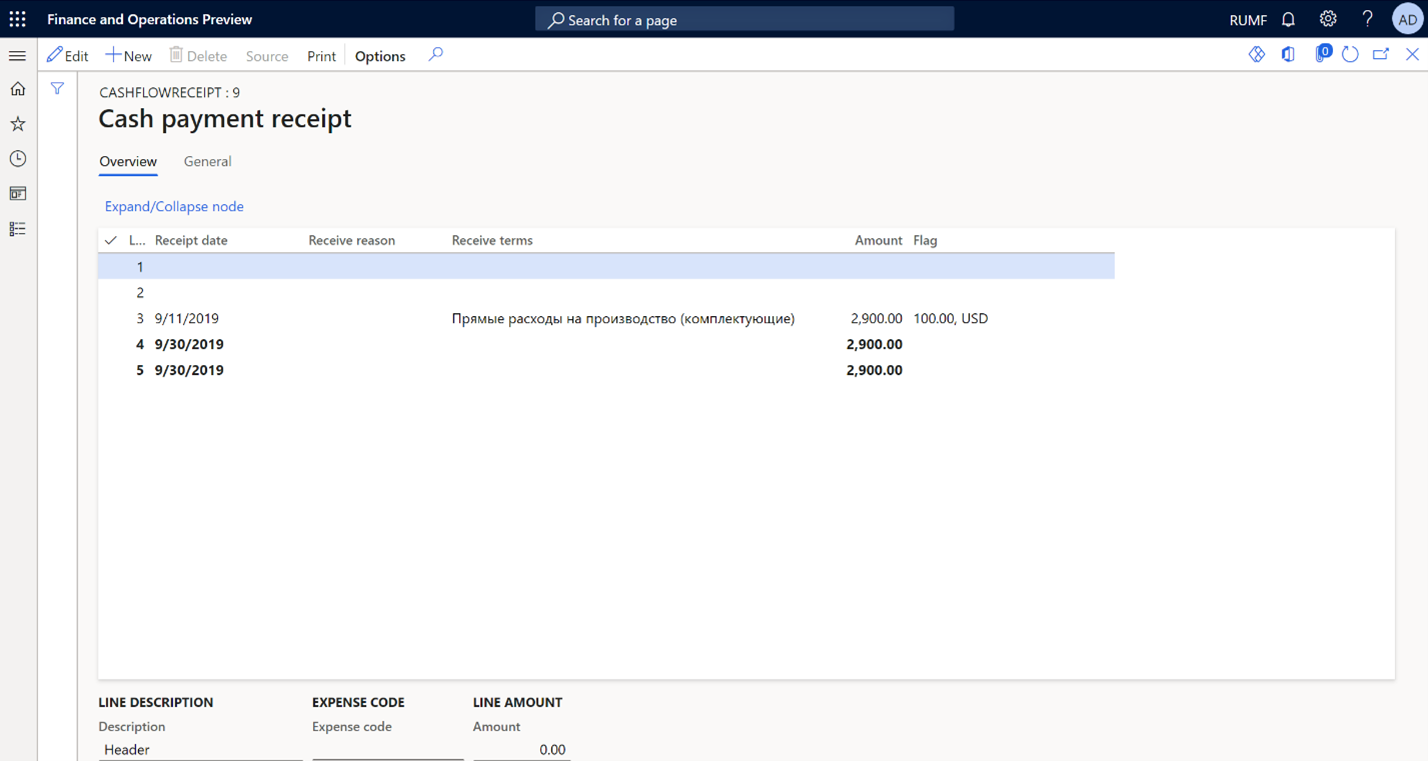

Cash payment receipt tax register

Calculate the tax register as described in Create tax registers and the tax register journal.

The Cash payment receipt tax register shows all cash receipt transactions, based on the settings that you configured earlier in this article. You can view the total for the whole tax register and also the totals for each Receive reason value.

The tax register lines show the following information:

- Receipt date: The date when funds were received in the organization's current account or the cash account. This date is determined based on primary documents, such as the account statement or cash receipt order.

- Receipt reason: Details of the primary document, such as the number of the incoming cash order or bank payment order.

- Receipt terms: The conditions for the receipt of funds.

- Amount: The amount of the receipt. This value is taken from the corresponding source document.

- Flag: The amount and currency code, if the funds were received in a foreign currency. This value is taken from the corresponding source document.

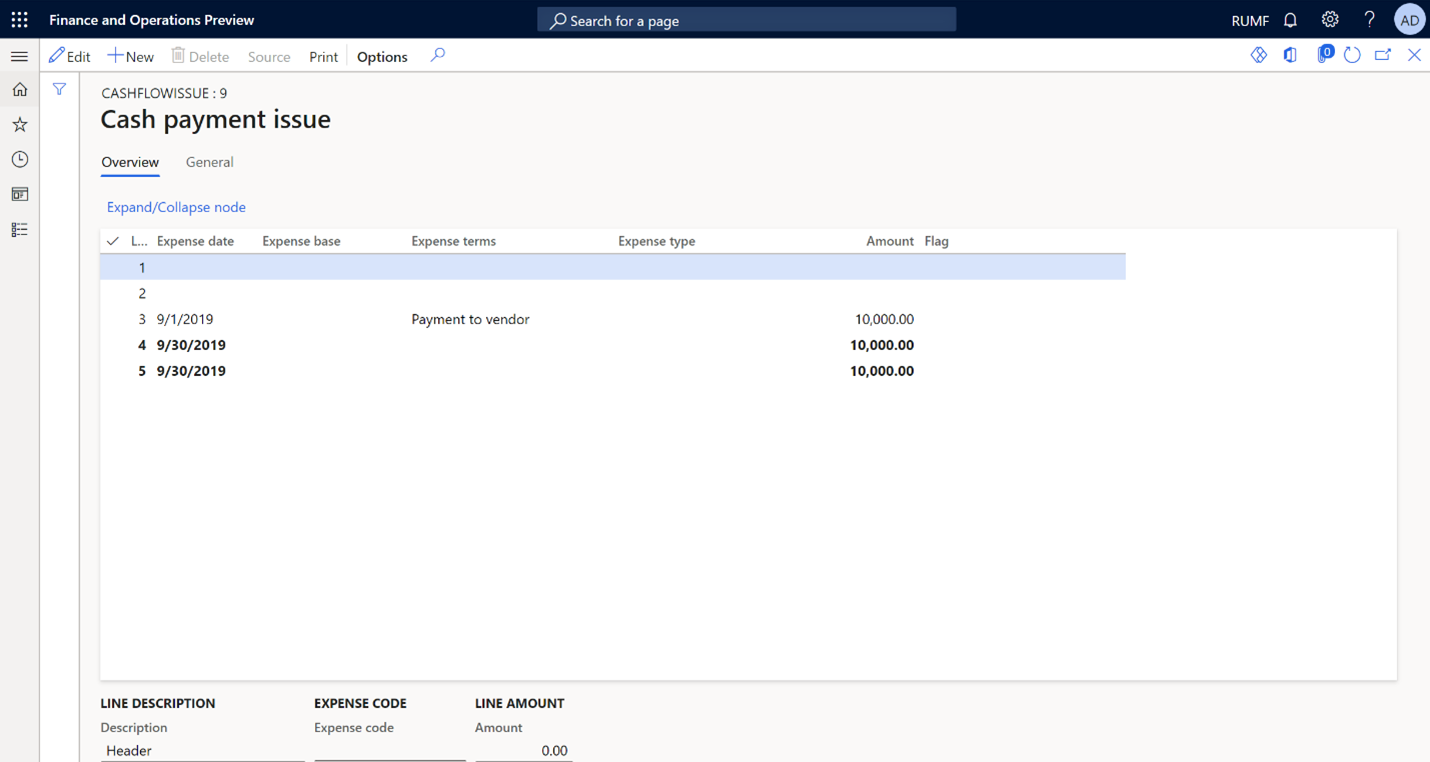

Cash payment issue tax register

Calculate the tax register as described in Create tax registers and the tax register journal.

The Cash payment issue tax register shows all cash issue transactions, based on the settings that you configured earlier in this article. You can view the total for the whole tax register and also the totals for each expense type.

The tax register lines show the following information:

- Expense date: The date when funds were withdrawn from the company's current account or the cash account. This date is determined based on primary documents.

- Expense base: Details of the document that funds were withdrawn for, such as the number of the outgoing cash order or bank payment order.

- Expense terms: The conditions for the withdrawal of funds. Expense terms can be payment, advance payment, refund of previously received advances, or provision of funds on the terms of a refund.

- Expense type: The type of expense. Expenses can be contributions, deposits and other mandatory payments, voluntary insurance contributions, compensation for the use of personal cars, payment of lifting special funds, expenditure of special funds, or other conditions or types of expenses.

- Amount: The amount of the withdrawal. This value is taken from the corresponding source document.

- Flag: The amount and currency code, if the funds were withdrawn in a foreign currency. This value is taken from the corresponding source document.