Events

Take the Microsoft Learn Challenge

Nov 19, 11 PM - Jan 10, 11 PM

Ignite Edition - Build skills in Microsoft Azure and earn a digital badge by January 10!

Register nowThis browser is no longer supported.

Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support.

This content applies to: ![]() v4.0 (GA) | Previous versions:

v4.0 (GA) | Previous versions: ![]() v3.1 (GA)

:::moniker-end

v3.1 (GA)

:::moniker-end

This content applies to: ![]() v3.1 (GA) | Latest version:

v3.1 (GA) | Latest version: ![]() v4.0 (GA)

v4.0 (GA)

The Document Intelligence tax model uses powerful Optical Character Recognition (OCR) capabilities to analyze and extract key fields and line items from a select group of tax documents. Tax documents can be of various formats like 1099, 1098, W2, 1040, 1095A, 1095C, W-4, 1099-SSA. Input format can include phone-captured images, scanned documents, and digital PDFs. The API analyzes document text; extracts key information and returns a structured JSON data representation. The model currently supports certain English tax document formats.

Supported tax form types:

Automated tax document processing is the process of extracting key fields from tax documents. Historically, tax documents were processed manually. This model allows for the easy automation of tax scenarios.

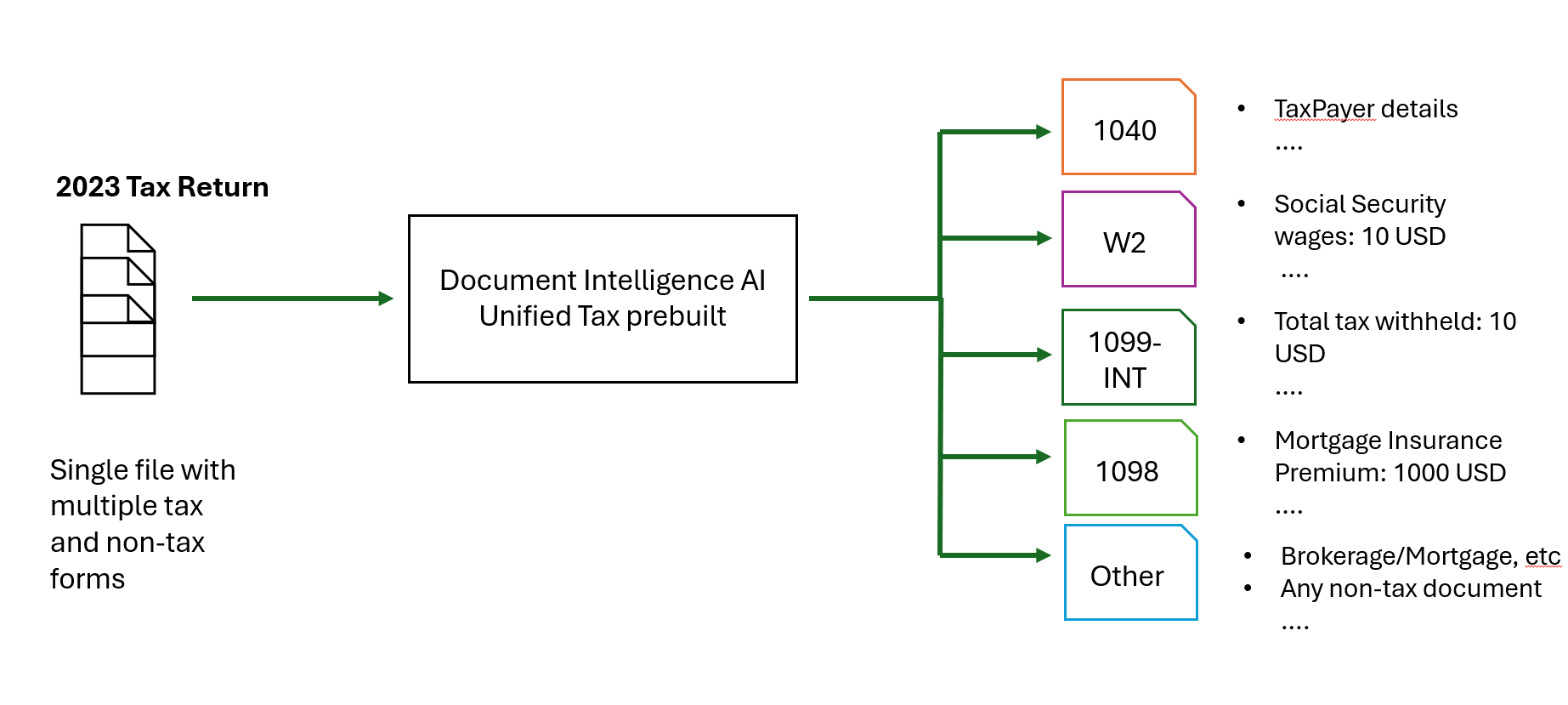

The Unified US Tax prebuilt model automatically detects and extracts data from W2, 1098, 1040, and 1099 tax forms in submitted documents. These documents can be composed of many tax or non-tax-related documents. The model only processes the forms it supports.

Document Intelligence v4.0: 2024-11-30 (GA) supports the following tools, applications, and libraries:

| Feature | Resources | Model ID |

|---|---|---|

| US tax form models | • Document Intelligence Studio • REST API • C# SDK • Python SDK • Java SDK • JavaScript SDK |

• prebuilt-tax.us • prebuilt-tax.us.W-2 • prebuilt-tax.us.W-4 • prebuilt-tax.us.1095A • prebuilt-tax.us.1095C • prebuilt-tax.us.1098 • prebuilt-tax.us.1098E • prebuilt-tax.us.1098T • prebuilt-tax.us.1099A • prebuilt-tax.us.1099B • prebuilt-tax.us.1099C • prebuilt-tax.us.1099CAP • prebuilt-tax.us.1099Combo • prebuilt-tax.us.1099DIV • prebuilt-tax.us.1099G • prebuilt-tax.us.1099H • prebuilt-tax.us.1099INT • prebuilt-tax.us.1099K • prebuilt-tax.us.1099LS • prebuilt-tax.us.1099LTC • prebuilt-tax.us.1099MISC • prebuilt-tax.us.1099NEC • prebuilt-tax.us.1099OID • prebuilt-tax.us.1099PATR • prebuilt-tax.us.1099Q • prebuilt-tax.us.1099QA • prebuilt-tax.us.1099R • prebuilt-tax.us.1099S • prebuilt-tax.us.1099SA • prebuilt-tax.us.1099SB • prebuilt-tax.us.1099SSA • prebuilt-tax.us.1040 • prebuilt-tax.us.1040Schedule1 • prebuilt-tax.us.1040Schedule2 • prebuilt-tax.us.1040Schedule3 • prebuilt-tax.us.1040Schedule8812 • prebuilt-tax.us.1040ScheduleA • prebuilt-tax.us.1040ScheduleB • prebuilt-tax.us.1040ScheduleC • prebuilt-tax.us.1040ScheduleD • prebuilt-tax.us.1040ScheduleE • prebuilt-tax.us.1040ScheduleEIC • prebuilt-tax.us.1040ScheduleF • prebuilt-tax.us.1040ScheduleH • prebuilt-tax.us.1040ScheduleJ • prebuilt-tax.us.1040ScheduleR • prebuilt-tax.us.1040ScheduleSE • prebuilt-tax.us.1040Senior |

Document Intelligence v3.1 supports the following tools, applications, and libraries:

| Feature | Resources | Model ID |

|---|---|---|

| US tax form models | • Document Intelligence Studio • REST API • C# SDK • Python SDK • Java SDK • JavaScript SDK |

• prebuilt-tax.us.W-2 • prebuilt-tax.us.1098 • prebuilt-tax.us.1098E • prebuilt-tax.us.1098T |

Document Intelligence v3.0 supports the following tools, applications, and libraries:

| Feature | Resources | Model ID |

|---|---|---|

| US tax form models | • Document Intelligence Studio • REST API • C# SDK • Python SDK • Java SDK • JavaScript SDK |

• prebuilt-tax.us.W-2 • prebuilt-tax.us.1098 • prebuilt-tax.us.1098E • prebuilt-tax.us.1098T |

Supported file formats:

| Model | Image: JPEG/JPG, PNG, BMP, TIFF, HEIF |

Microsoft Office: Word ( DOCX), Excel (XLSX), PowerPoint (PPTX), HTML |

|

|---|---|---|---|

| Read | ✔ | ✔ | ✔ |

| Layout | ✔ | ✔ | ✔ |

| General Document | ✔ | ✔ | |

| Prebuilt | ✔ | ✔ | |

| Custom extraction | ✔ | ✔ | |

| Custom classification | ✔ | ✔ | ✔ |

For best results, provide one clear photo or high-quality scan per document.

For PDF and TIFF, up to 2,000 pages can be processed (with a free tier subscription, only the first two pages are processed).

The file size for analyzing documents is 500 MB for paid (S0) tier and 4 MB for free (F0) tier.

Image dimensions must be between 50 pixels x 50 pixels and 10,000 pixels x 10,000 pixels.

If your PDFs are password-locked, you must remove the lock before submission.

The minimum height of the text to be extracted is 12 pixels for a 1024 x 768 pixel image. This dimension corresponds to about 8 point text at 150 dots per inch (DPI).

For custom model training, the maximum number of pages for training data is 500 for the custom template model and 50,000 for the custom neural model.

For custom extraction model training, the total size of training data is 50 MB for template model and 1 GB for the neural model.

For custom classification model training, the total size of training data is 1 GB with a maximum of 10,000 pages. For 2024-11-30 (GA), the total size of training data is 2 GB with a maximum of 10,000 pages.

See how data, including customer information, vendor details, and line items, is extracted from invoices. You need the following resources:

An Azure subscription—you can create one for free.

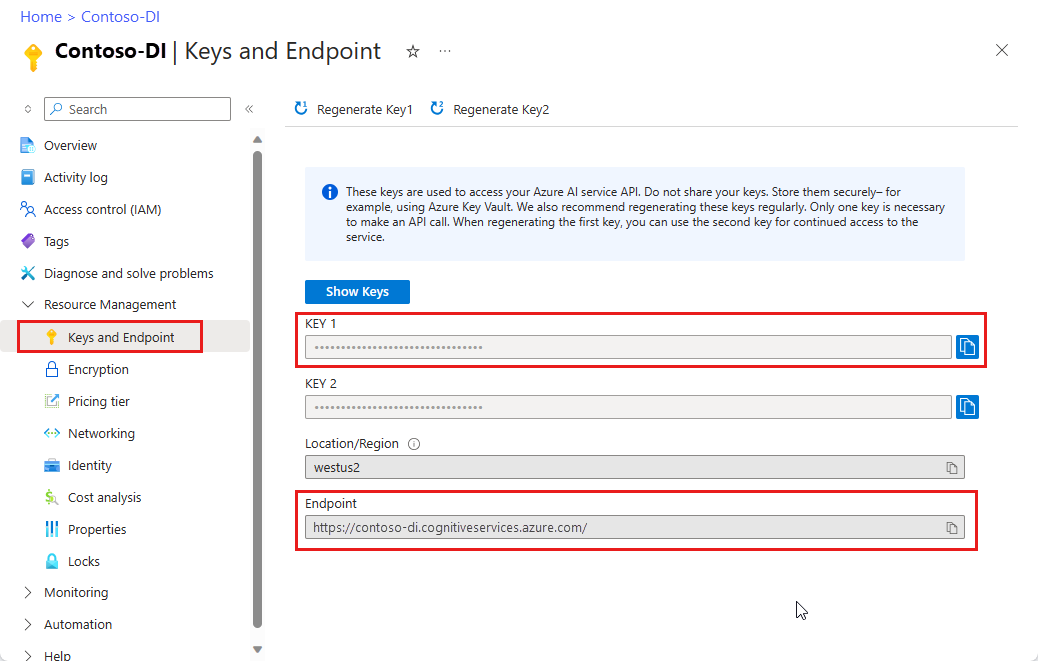

A Document Intelligence instance in the Azure portal. You can use the free pricing tier (F0) to try the service. After your resource deploys, select Go to resource to get your key and endpoint.

On the Document Intelligence Studio home page, select the supported tax document model.

You can analyze a sample tax document or upload your own files.

Select the Run analysis button and, if necessary, configure the Analyze options :

See our Language Support—prebuilt models page for a complete list of supported languages.

For supported document extraction fields, see the tax document model schema pages in our GitHub sample repository.

The tax documents key-value pairs and line items extracted are in the documentResults section of the JSON output.

Try processing your own forms and documents with the Document Intelligence Studio.

Complete a Document Intelligence quickstart and get started creating a document processing app in the development language of your choice.

Events

Take the Microsoft Learn Challenge

Nov 19, 11 PM - Jan 10, 11 PM

Ignite Edition - Build skills in Microsoft Azure and earn a digital badge by January 10!

Register now