Electronic invoicing onboarding in Saudi Arabia

Onboarding is mandatory for all taxpayers who are subject to electronic invoicing in Saudi Arabia. As a result of the onboarding process, taxpayers obtain Cryptographic Stamp Identifiers (CSIDs). CSIDs are required for integration with the electronic invoicing portal that is managed by the Saudi Arabian tax authority (ZATCA) and for further submission of electronic invoices.

This article explains how to onboard taxpayers and their electronic invoicing software with Saudi Arabian tax authorities.

Prerequisites

- The legal entity must be registered as a taxpayer in Saudi Arabia and must have a valid value-added tax (VAT) registration number.

- The legal entity must have the access to the Saudi Arabian Taxation Portal (ERAD).

Onboarding process

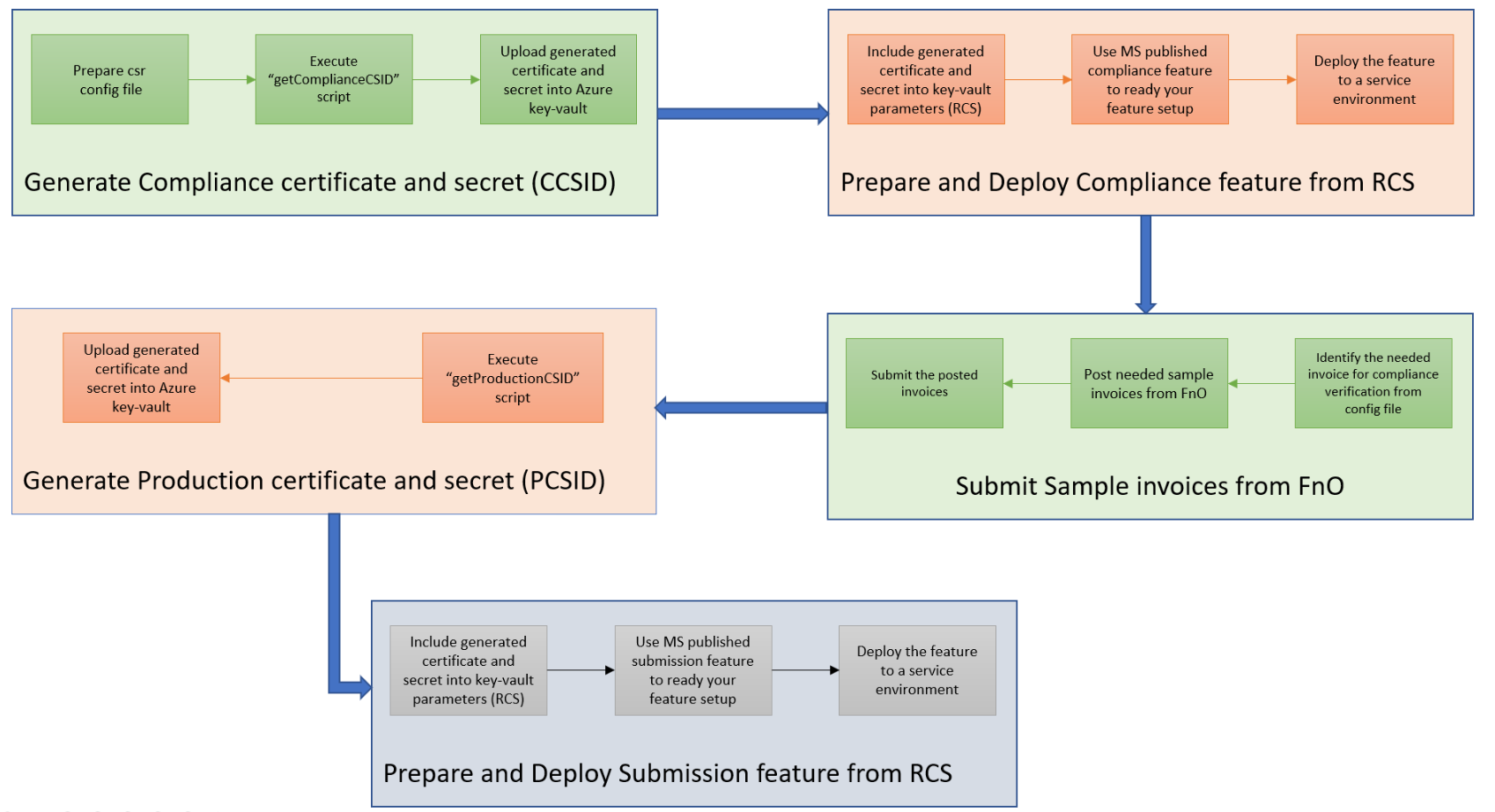

The onboarding process consists of two steps:

- Obtain a Compliance CSID (CCSID), which ZATCA assigns to perform compliance checks of Electronic invoice generation solutions (EGSs).

- Obtain a Production CSID (PCSID), which ZATCA assigns to compliant EGSs.

Obtain a CCSID

In the Saudi Arabian Taxation Portal (ERAD), go to the Onboarding and Management Portal by selecting the relevant tile.

On the main landing page of the Onboarding and Management Portal, select the Onboard new solution unit/device tile, and then select Generate OTP code. The OTP code is only valid for one hour after it's generated. Make sure that it's used within that time frame.

Select the number of one-time password (OTP) codes to generate. The number depends on the number of e-invoicing generation units (devices) that will be used.

Save the generated OTP codes so that you can use them in later steps.

Prepare a configuration file for the certificate signing request. This configuration file should be in the form of a plain text file that contains the following data.

oid_section = OIDs [OIDs] certificateTemplateName = 1.3.6.1.4.1.311.20.2 [req] default_bits = 2048 emailAddress = MyEmail@email.com req_extensions = v3_req x509_extensions = v3_ca prompt = no default_md = sha 256 req_extensions = req_ext distinguished_name = dn [dn] C=SA OU=Riyad Branch O=Contoso CN=EA123456789 [v3_req] basicConstraints = CA:FALSE keyUsage = digitalSignature, nonRepudiation, keyEncipherment [req_ext] certificateTemplateName = ASN1:PRINTABLESTRING:ZATCA-Code-Signing subjectAltName = dirName:alt_names [alt_names] SN=1-TST|2-TST|3-ed22f1d8-e6a2-1118-9b58-d9a8f11e445f UID=310122393500003 title=1100 registeredAddress= MyAddress businessCategory=IndustrySave the file to the same location as the on boarding script with the name, csr_config.txt.

In the configuration file, update the emailAddress value and the following specific data.

Code Description Specification C The country/region code. A two-letter code (ISO 3166 Alpha-2) OU The name of the organization unit. For normal taxpayers, the value is free text. For VAT groups, identify the value through the eleventh digit of the organization identifier being "1". Validate that the input is a 10-digit Tax Identification Number (TIN). O The name of the organization or taxpayer. Free text CN The unique name of the solution or unit. Free text SN The unique identification code for the solution. Free text UID The VAT registration number of the taxpayer. Fifteen digits. This number begins with "3" and ends with "3". title The document type that the taxpayer's solution unit will issue. Four-digit numerical input that uses "0" and "1" mapped to "TSCZ": 0 = False/Not supported, 1 = True/Supported. T = Tax invoice (standard), S = Simplified tax invoice, C = For future use, Z = For future use. registeredAddress The address of the branch or location where the device or solution unit is primarily situated. Free text businessCategory The industry or sector that the device or solution will generate invoices for. Free text Note

The values for CN and certificateTemplateName in the config file are different when you use the simulation portal.

In the simulation portal:

- CN - PREZATCA-Code-Signing

- certificateTemplateName - ASN1:PRINTABLESTRING:PREZATCA-Code-Signing

For any other case, use the values as instructed above.

Run the onboarding script that is provided later in this article. Specify the OTP and configuration file as input parameters. Here is an example: Script has two possible endpoints simulation and prod.

.\OnboardingScript.ps1 -action getComplianceCSID -endpoint prod -otp 123345 -csrconfig .\csr_config.txt -password 123Note

The password parameter is optional and can be omitted. If it's included, the certificate that is generated will have the specified password.

The CCSID is received as a certificate file "CCSID.pfx", and the secret for CCSID is saved as txt file "CCSIDSecret.txt". Save this CCSID certificate file in the Microsoft Azure key vault certificate and save the secret in Microsoft Azure key vault secret. For more information, see Customer certificates and secrets.

Configure the related feature setup in the Saudi Arabian ZATCA compliance check (SA) electronic invoicing feature and reference the CCSID certificate that you saved in the key vault. The certificate will be used for communication with the ZATCA electronic invoicing portal.

Compliance check

After you obtain Compliance CSID using the PowerShell script, ZATCA requires you to complete certain compliance checks by submitting sample invoices. This step is a prerequisite to request a Production CSID.

Ensure that all types of sample invoices that were configured in the Certificate Signing Request (CSR) configuration file are successfully submitted to ZATCA. Use the standard process for issuing electronic invoices. For more details, see Issue electronic invoices in Finance and Supply Chain Management.

Use the feature, "Saudi Arabian ZATCA compliance check (SA)" in RCS and follow the Country/region-specific Configuration section steps using the Compliance CSID you obtained.

After the compliance checks are successfully complete, use the PowerShell script to obtain Production CSID (refer on-boarding script).

Note

In the Title field, if the document type in the configuration file is set to 1000, three sample invoices must be submitted for the compliance check:

- Standard Tax Invoice

- Standard Debit Note

- Standard Credit Note

In the Title field, if the document type in the configuration file is set to 0100, three sample invoices must be submitted for the compliance check:

- Simplified Tax Invoice

- Simplified Debit Note

- Simplified Credit Note

If the document type is set to 1100, all six sample invoices must be submitted for the compliance check.

Obtain a PCSID

To obtain a PCSID, you must correctly configure the solution for electronic invoice generation and submission, and the solution must be fully functioning. To achieve this result, you must complete all the required preliminary configuration steps. For more information, see Get started with Electronic invoicing for Saudi Arabia.

Make sure that all electronic invoices are successfully submitted to ZATCA.

Run the onboarding script that is provided later in this article. Specify the CCSID as an input parameter. Here is an example: Script has two possible endpoints simulation & prod

.\OnboardingScript.ps1 -action getProductionCSID -endpoint prod -password 123Note

The password parameter is optional and can be omitted. If it's included, the certificate that is generated will have the specified password.

The PCSID is received as a certificate file in PFX format. Save this PCSID certificate and secret file in the Azure key vault.

Configure the related feature setup in the Saudi Arabian Zatca submission (SA) electronic invoicing feature. Include the PCSID certificate and secret in the key vault parameters in RCS.

After you complete all the configurations steps, the system is ready to be used in production mode.

To review obtained CSIDs on the ZATCA side, use the Review Existing Cryptographic Stamp Identifier (CSID) tile on the landing page of the Onboarding and Management Portal. This portal is accessible from the main Saudi Arabian Taxation Portal (ERAD).

Onboarding script

Note

The sample scripts aren't supported under any Microsoft standard support program or service. The sample scripts are provided AS IS without warranty of any kind. Microsoft further disclaims all implied warranties including, without limitation, any implied warranties of merchantability or of fitness for a particular purpose. The entire risk arising out of the use or performance of the sample scripts and documentation remains with you. In no event shall Microsoft, its authors, or anyone else involved in the creation, production, or delivery of the scripts be liable for any damages whatsoever (including, without limitation, damages for loss of business profits, business interruption, loss of business information, or other pecuniary loss) arising out of the use of or inability to use the sample scripts or documentation, even if Microsoft has been advised of the possibility of such damages.

Use the following Windows PowerShell script to obtain a CCSID and a PCSID.

#Saudi Arabian electronic invoice onboarding script #Version 1.1 param($action, $endpoint, $otp, $csrconfig, $password) $env:path = $env:path + ";C:\Program Files\Git\usr\bin" $simulationEndpoint = 'https://gw-fatoora.zatca.gov.sa/e-invoicing/simulation' $prodEndpoint = 'https://gw-fatoora.zatca.gov.sa/e-invoicing/core' if ($endpoint -eq "simulation") { $serviceEndpoint = $simulationEndpoint } elseif ($endpoint -eq "prod") { $serviceEndpoint = $prodEndpoint } else { Write-Host "`nMissing parameter (with values simulation/prod): endpoint" Break } if ($action -eq "getComplianceCSID") { if (-not (Test-Path -Path $csrconfig)) { throw "CSR configuration file does not exist, please make sure to provide a valid file path for the '-csrconfig' parameter." } if ($otp -eq $null) { throw "OTP code is not provided, please carry correct parameters." } #Generate private key openssl ecparam -name secp256k1 -genkey -noout -out privatekey.pem Write-Host "Private key generated." #Generate public key openssl ec -in privatekey.pem -pubout -conv_form compressed -out publickey.pem Write-Host "Public key generated." #Generate CSR(Certificate signing request) openssl base64 -d -in publickey.pem -out publickey.bin openssl req -new -sha256 -key privatekey.pem -extensions v3_req -config $csrconfig -out .\taxpayer.csr openssl base64 -in taxpayer.csr -out taxpayerCSRbase64Encoded.txt $CSRbase64Encoded = Get-Content -path taxpayerCSRbase64Encoded.txt -Raw $CSRbase64Encoded = $CSRbase64Encoded -replace "`n","" $CSRbase64Encoded = $CSRbase64Encoded -replace "`r","" #Init request for CCSID $postParams = @{"csr"=$CSRbase64Encoded} | ConvertTo-Json $postHeader = @{ "Accept"="application/json" "OTP"=$otp "Content-Type"="application/json" "Accept-Version"="V2"} echo $CSRbase64Encoded try { $response = Invoke-WebRequest -Uri $serviceEndpoint'/compliance' -Method POST -Body $postParams -Headers $postHeader } catch { $respStream = $_.Exception.Response.GetResponseStream() $reader = New-Object System.IO.StreamReader($respStream) $respBody = $reader.ReadToEnd() $reader.Close() Write-Host "`nZatca service communication error:" Write-Host $_.Exception.Message Write-Host "Detailed error message: " $respBody Write-Host "The process of obtaining a Compliance CSID (CCSID) is interrupted." } if ($response -ne $null) { $response = $response | ConvertFrom-Json $requestId = $response.requestID Write-Host "Request ID:" Write-Host $requestId $requestId | Out-File -FilePath .\requestId.txt -Encoding utf8 -NoNewline $CCSIDbase64 = $response.binarySecurityToken Write-Host "`nCompliance CSID received from Zatca:" Write-Host $CCSIDbase64 $CCSID = [System.Text.Encoding]::UTF8.GetString([System.Convert]::FromBase64String($CCSIDbase64)) $CCSIDCertString = "-----BEGIN CERTIFICATE-----`n" + $CCSID + "`n" + "-----END CERTIFICATE-----" $CCSIDSecret = $response.secret Write-Host "`nCompliance CSID secret received from Zatca:" Write-Host $CCSIDSecret $CCSIDStringFileName = "CCSIDString.txt" $CCSIDSecretFileName = "CCSIDSecret.txt" $CCSIDCertFileName = "CCSID.pem" $CCSIDFolderPath = Get-Location $CCSIDCertFilePath = Join-Path $CCSIDFolderPath $CCSIDCertFileName $CCSIDStringFilePath = Join-Path $CCSIDFolderPath $CCSIDStringFileName $CCSIDSecretFilePath = Join-Path $CCSIDFolderPath $CCSIDSecretFileName $Utf8NoBomEncoding = New-Object System.Text.UTF8Encoding $False [System.IO.File]::WriteAllLines($CCSIDCertFilePath, $CCSIDCertString, $Utf8NoBomEncoding) [System.IO.File]::WriteAllLines($CCSIDStringFilePath, $CCSIDbase64, $Utf8NoBomEncoding) [System.IO.File]::WriteAllLines($CCSIDSecretFilePath, $CCSIDSecret, $Utf8NoBomEncoding) openssl pkcs12 -inkey privatekey.pem -in CCSID.pem -export -passout pass:$password -out CCSID.pfx Write-Host "`nCertificate is saved to CCSID.pfx file and secret is saved to CCSIDSecret.txt file." Write-Host "The process of obtaining a Compliance CSID (CCSID) is complete, please process the compliance check and do not delete or move any created files before getting PCSID." } } if ($action -eq "getProductionCSID") { if (-not (Test-Path -Path requestId.txt)) { throw "'requestId.txt' file is missing, please make sure you're running the script in the same location where the results of getting the CCSID are stored." } if (-not (Test-Path -Path CCSIDString.txt)) { throw "'CCSIDString.txt' file is missing, please make sure you're running the script in the same location where the results of getting the CCSID are stored." } if (-not (Test-Path -Path CCSIDSecret.txt)) { throw "'CCSIDSecret.txt' file is missing, please make sure you're running the script in the same location where the results of getting the CCSID are stored." } $requestId = Get-Content -path requestId.txt -Raw $requestId = $requestId -replace "`n","" $requestId = $requestId -replace "`r","" Write-Host "Request ID is:" $requestId $CCSID = Get-Content -path CCSIDString.txt -Raw $CCSID = $CCSID -replace "`n","" $CCSID = $CCSID -replace "`r","" Write-Host "`nCompliance CSID read locally:" Write-Host $CCSID $CCSIDSecretString = Get-Content -path CCSIDSecret.txt -Raw $CCSIDSecretString = $CCSIDSecretString -replace "`n","" $CCSIDSecretString = $CCSIDSecretString -replace "`r","" Write-Host "`nCompliance CSID secret read locally:" Write-Host $CCSIDSecretString $AuthTokenString = $CCSID + ":" + $CCSIDSecretString $BasicAuthToken = "Basic " + [Convert]::ToBase64String([System.Text.Encoding]::UTF8.GetBytes($AuthTokenString)) #Init request for Production CSID (PCSID) $postParams = @{"compliance_request_id"=$requestId} | ConvertTo-Json $postHeader = @{ "Accept"="application/json" "Authorization"=$BasicAuthToken "Content-Type"="application/json" "Accept-Version"="V2"} try { $response = Invoke-WebRequest -Uri $serviceEndpoint'/production/csids' -Method POST -Body $postParams -Headers $postHeader } catch { $respStream = $_.Exception.Response.GetResponseStream() $reader = New-Object System.IO.StreamReader($respStream) $respBody = $reader.ReadToEnd() $reader.Close() Write-Host "`nZatca service communication error:" Write-Host $_.Exception.Message Write-Host "Detailed error message: " $respBody Write-Host "Please make sure the compliance check process has been done before obtaining a Production CSID (PCSID)." Write-Host "The process of obtaining a Production CSID (PCSID) is interrupted." } if ($response -ne $null) { $response = $response | ConvertFrom-Json $PCSIDbase64 = $response.binarySecurityToken Write-Host "`nProduction CSID received from Zatca:" Write-Host $PCSIDbase64 $PCSID = [System.Text.Encoding]::UTF8.GetString([System.Convert]::FromBase64String($PCSIDbase64)) $PCSIDCertString = "-----BEGIN CERTIFICATE-----`n" + $PCSID + "`n" + "-----END CERTIFICATE-----" $PCSIDSecret = $response.secret Write-Host "`nProduction CSID secret received from Zatca:" Write-Host $PCSIDSecret $PCSIDCertFileName = "PCSID.pem" $PCSIDSecretFileName = "PCSIDSecret.txt" $PCSIDFolderPath = Get-Location $PCSIDCertFilePath = Join-Path $PCSIDFolderPath $PCSIDCertFileName $PCSIDSecretFilePath = Join-Path $PCSIDFolderPath $PCSIDSecretFileName $Utf8NoBomEncoding = New-Object System.Text.UTF8Encoding $False [System.IO.File]::WriteAllLines($PCSIDCertFilePath, $PCSIDCertString, $Utf8NoBomEncoding) [System.IO.File]::WriteAllLines($PCSIDSecretFilePath, $PCSIDSecret, $Utf8NoBomEncoding) # Sandbox API will get error: openssl : No certificate matches private key openssl pkcs12 -inkey privatekey.pem -in PCSID.pem -export -passout pass:$password -out PCSID.pfx if (Test-Path -Path PCSID.pfx) { Write-Host "`nCertificate is saved to PCSID.pfx file and secret is saved to PCSIDSecret.txt file." Write-Host "The process of obtaining a Production CSID (PCSID) is complete." } else { Write-Host "`nThe process of obtaining a Production CSID (PCSID) is interrupted." } } }Save the output .pfx certificate file that is received in the key vault.